Yücekaya, Ahmet Deniz

Loading...

Profile URL

Name Variants

A. Yücekaya

YÜCEKAYA, AHMET DENIZ

Yücekaya, A.

Yucekaya A.

Yücekaya, Ahmet Deniz

Yücekaya,A.D.

Ahmet Deniz, Yucekaya

Ahmet Deniz YÜCEKAYA

Yücekaya, A. D.

AHMET DENIZ YÜCEKAYA

Yucekaya,Ahmet Deniz

A. D. Yücekaya

Yucekaya,A.D.

Ahmet Deniz Yücekaya

Yucekaya, Ahmet Deniz

YÜCEKAYA, Ahmet Deniz

Y.,Ahmet Deniz

Yücekaya, AHMET DENIZ

Y., Ahmet Deniz

Yücekaya, Ahmet Çelebi

Yücekaya, Ahmet Deniz

Yucekaya, Ahmet

Yücekaya, Ahmet

YÜCEKAYA, AHMET DENIZ

Yücekaya, A.

Yucekaya A.

Yücekaya, Ahmet Deniz

Yücekaya,A.D.

Ahmet Deniz, Yucekaya

Ahmet Deniz YÜCEKAYA

Yücekaya, A. D.

AHMET DENIZ YÜCEKAYA

Yucekaya,Ahmet Deniz

A. D. Yücekaya

Yucekaya,A.D.

Ahmet Deniz Yücekaya

Yucekaya, Ahmet Deniz

YÜCEKAYA, Ahmet Deniz

Y.,Ahmet Deniz

Yücekaya, AHMET DENIZ

Y., Ahmet Deniz

Yücekaya, Ahmet Çelebi

Yücekaya, Ahmet Deniz

Yucekaya, Ahmet

Yücekaya, Ahmet

Job Title

Prof. Dr.

Email Address

Main Affiliation

Industrial Engineering

Status

Current Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

3

GOOD HEALTH AND WELL-BEING

1

Research Products

6

CLEAN WATER AND SANITATION

4

Research Products

7

AFFORDABLE AND CLEAN ENERGY

6

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

1

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

4

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

6

Research Products

12

RESPONSIBLE CONSUMPTION AND PRODUCTION

3

Research Products

13

CLIMATE ACTION

2

Research Products

Documents

34

Citations

531

h-index

13

Documents

22

Citations

418

Scholarly Output

38

Articles

23

Views / Downloads

202/4935

Supervised MSc Theses

9

Supervised PhD Theses

2

WoS Citation Count

354

Scopus Citation Count

435

WoS h-index

11

Scopus h-index

12

Patents

0

Projects

0

WoS Citations per Publication

9.32

Scopus Citations per Publication

11.45

Open Access Source

25

Supervised Theses

11

Google Analytics Visitor Traffic

| Journal | Count |

|---|---|

| International Journal of Energy Economics and Policy | 3 |

| Energy Sources, Part B: Economics, Planning, and Policy | 3 |

| Renewable and Sustainable Energy Reviews | 2 |

| Energy Strategy Reviews | 2 |

| Journal of Hydrologic Engineering | 2 |

Current Page: 1 / 4

Scopus Quartile Distribution

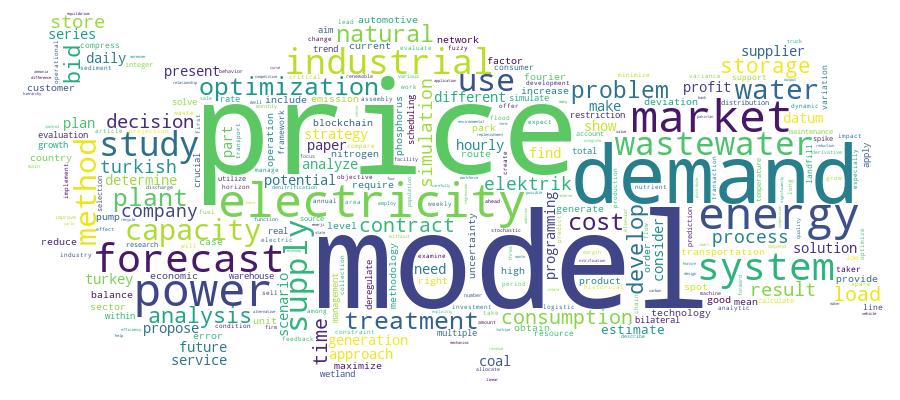

Competency Cloud

Scholarly Output Search Results

Now showing 1 - 10 of 38

Article Citation - WoS: 44Citation - Scopus: 51Hourly Electricity Demand Forecasting Using Fourier Analysis With Feedback(Elsevıer, 2020) Yükseltan, Ergün; Yücekaya, Ahmet; Bilge, Ayşe HumeyraWhether it be long-term, like year-ahead, or short-term, such as hour-ahead or day-ahead, forecasting of electricity demand is crucial for the success of deregulated electricity markets. The stochastic nature of the demand for electricity, along with parameters such as temperature, humidity, and work habits, eventually causes deviations from expected demand. In this paper, we propose a feedback-based forecasting methodology in which the hourly prediction by a Fourier series expansion is updated by using the error at the current hour for the forecast at the next hour. The proposed methodology is applied to the Turkish power market for the period 2012-2017 and provides a powerful tool to forecasts the demand in hourly, daily and yearly horizons using only the past demand data. The hourly forecasting errors in the demand, in the Mean Absolute Percentage Error (MAPE) norm, are 0.87% in hour-ahead, 2.90% in day-ahead, and 3.54% in year-ahead horizons, respectively. An autoregressive (AR) model is also applied to the predictions by the Fourier series expansion to obtain slightly better results. As predictions are updated on an hourly basis using the already realized data for the current hour, the model can be considered as reliable and practical in circumstances needed to make bidding and dispatching decisions.Article Citation - WoS: 32Citation - Scopus: 35Scheduling a Log Transport System Using Simulated Annealing(Elsevier Science, 2014) Haridass, Karunakaran; Valenzuela, Jorge; Yücekaya, Ahmet; McDonald, TimThe log truck scheduling problem under capacity constraints and time window constraints is an NP-hard problem that involves the design of best possible routes for a set of trucks serving multiple loggers and mills. The objective is to minimize the total unloaded miles traveled by the trucks. In this paper a simulated annealing - a meta-heuristic optimization method - that interacts with a deterministic simulation model of the log transport system in which the precedence and temporal relations among activities are explicitly accounted for is proposed. The results obtained by solving a small size problem consisting of four trucks two mills three loggers and four truck trips showed that the best solution could be found in less than two minutes. In addition the solution method is tested using data provided by a log delivery trucking firm located in Mississippi. The firm operates sixty-eight trucks to deliver loads from twenty-two logging operations to thirteen mill destinations. The routes assigned by a supervisory person are used as a benchmark to compare the manual generated solution to the solution obtained using the proposed method. (C) 2013 Elsevier Inc. All rights reserved.Book Part A Network Model for the Location-Routing Decisions of a Logistics Company(Institute of Industrial Engineers, 2012) Sama, Funda; Yücekaya, Ahmet; Ayağ, ZekiIn this paper, part of the logistics network of one of the leading logistics companies in Turkey is analyzed. Data related to the candidate warehouse locations, supplies and demands of customers are collected. A network model is developed in order to reconfigure the logistics network. The aim of the mathematical model is to help decision makers decide on the locations of warehouses, as well as routing products from suppliers to the distribution center; from distribution center to warehouses; and finally from warehouses to customers. The mathematical model is solved optimally with LINGO solver, and the comparison of the current network with the optimal solution revealed that the overall operating costs can be reduced by approximately 7%.Master Thesis Sceheduling Pumped Hydro- Power Resources Under Price and Flow Uncertainty(Kadir Has Üniversitesi, 2012) Metin, Seda Sibel; Yücekaya, Ahmet DenizHydroelectric power plants should be preferred since they are environmentally friendly and they have low level of potential risks. Hydroelectric power plants are local resources that are environmentally compatible unpolluted capable of dealing with peak hour requirements highly efficient cost-free of fuel and playing a role as the insurance of energy prices. -- Abstract'dan.Article Citation - WoS: 4Citation - Scopus: 6Agent-Based Optimization To Estimate Nash Equilibrium in Power Markets(Taylor & Francis Inc, 2013) Yücekaya, Ahmet; Valenzuela, JorgeIn most deregulated power markets firms bid daily into a day-ahead power market. The auction mechanism supply and demand determine the equilibrium at each hour. In this environment firms aim to maximize their revenues by carefully determining their bids. This requires the development of effective computational methods that help them estimate their competitors' behaviors under incomplete information. In this article an agent-based method that uses particle swarm optimization is described to simulate the behavior of market participants. Particle swarm optimization is used in the bidding process and an agent-based model is applied to find a Nash equilibrium. Different stopping conditions are used to determine the equilibrium. Experimental results are presented for two power systems.Article Citation - Scopus: 1Electric Power Bid Determination and Evaluation for Price Taker Units Under Price Uncertainty(Econjournals, 2021) Yucekaya, Ahmet; Valenzuela, J.Power companies aim to maximize their profit which is highly related to the bidding strategies used. In order to sell electricity at high prices and maximize their profit, power companies need suitable bidding models that consider power operating constraints and price uncertainty within the market. Price taker units have no power to affect the prices but need to determine their best bidding strategy to maximize their profit assuming a quadratic cost function and uncertain market prices. Price taker units also need to evaluate their bidding strategy under different price scenarios. In this paper, we first model the bidding problem for a price taker unit and then propose quadratic programming, nonlinear programming and marginal cost based bidding models under price uncertainty. We use case studies to study the computation burden and limitation to reach a solution. We also propose a simulation methodology to evaluate the performance of each bidding strategy for different market prices in an effort to help decision makers to assess their bidding decisions. © 2021, Econjournals. All rights reserved.Article Citation - WoS: 11Citation - Scopus: 15Forecasting Models for Daily Natural Gas Consumption Considering Periodic Variations and Demand Segregation(Elsevier Ltd, 2020) Yükseltan, Ergün; Yücekaya, Ahmet; Bilge, Ayşe Hümeyra; Ağca Aktunç, EsraDue to expensive infrastructure and the difficulties in storage, supply conditions of natural gas are different from those of other traditional energy sources like petroleum or coal. To overcome these challenges, supplier countries require take-or-pay agreements for requested natural gas quantities. These contracts have many pre-clauses; even if they are not met due to low/high consumption or other external factors, buyers must completely fulfill them. A similar contract is then imposed on distributors and wholesale consumers. It is, thus, important for all parties to forecast their daily, monthly, and annual natural gas demand to minimize their risk. In this paper, a model consisting of a modulated expansion in Fourier series, supplemented by deviations from comfortable temperatures as a regressor is proposed for the forecast of monthly and weekly consumption over a one-year horizon. This model is supplemented by a day-ahead feedback mechanism for the forecast of daily consumption. The method is applied to the study of natural gas consumption for major residential areas in Turkey, on a yearly, monthly, weekly, and daily basis. It is shown that residential heating dominates winter consumption and masks all other variations. On the other hand, weekend and holiday effects are visible in summer consumption and provide an estimate for residential and industrial use. The advantage of the proposed method is the capability of long term projections, reflecting causality, and providing accurate forecasts even with minimal information.Article Citation - WoS: 1Landfill Gas To the Energy Potential of Turkey: a Scenario-Based Multi-Period Simulation(Taylor & Francis Inc, 2013) Yücekaya, AhmetTurkey is a developing country with increasing power demands and limited energy sources. Municipal solid waste processing landfilling and utilization of the gas to generate electric power and lower emissions has been used in developed countries for decades however it is relatively new in Turkey. The new regulations force municipalities in the country to build landfills to safely store the waste and secure the emission gases. The landfill gas can be utilized to produce energy and heat or if the quality is high it can be transported to a natural gas pipeline. In this article an overview of landfill gas-to-energy plants in the world is presented and the situation in Turkey is analyzed. A multi-period simulation methodology for municipalities is proposed to estimate the potential power generation and amount of methane that can be prevented. The municipalities in Turkey were classified into three categories and a scenario-based simulation is performed to estimate the energy generation and emission reduction that the country can gain if the landfill projects are activated according to the scenarios.Article Citation - WoS: 11Citation - Scopus: 17A Fuzzy Anp-Based Gra Approach To Evaluate Erp Packages(IGI Global, 2019) Ayağ, Zeki; Yücekaya, AhmetOne of the major problems that most companies face with during the implementation of an ERP system is to determine the best satisfying ERP software based on their needs and expectations. Because an improperly selected ERP software might lead to time loss and increased costs and in the long run a loss of market share. Therefore the ERP evaluation process for companies becomes to a vital point. On the other hand evaluating ERP software alternatives under a set of criteria leads us to a multiple-criteria decision making (MCDM) problem and needs to use proper MCDM methods. In the current literature a number of the MCDM methods have been proposed to solve these kinds of problems both of which are the analytic network process (ANP) of Saaty and grey relational analysis (GRA) which has been widely used in solving MCDM selection problems in various fields. Moreover in this article the authors used the fuzzy extension of the ANP method to reflect the uncertainty and ambiguity of decision maker(s) into problem in order to reach more reliable solution. As the fuzzy ANP method was used to calculate the priority weights of the evaluation criteria the GRA method with fuzzy interval-values was employed to rank a set of the possible ERP software alternatives. The proposed approach was also validated in a case study to show its applicability to potential readers and practitioners. Copyright © 2019 IGI Global. Copying or distributing in print or electronic forms without written permission of IGI Global is prohibited.Doctoral Thesis Trend Forecast and Collection Management in Apparel Retail(Kadir Has Üniversitesi, 2022) Arkan, Ramazan; Agca Aktunc, Esra; Yücekaya, Ahmet DenizThis study addresses the new methods and some existing methods with a different approach for trend forecasting and using new trends in the collections in apparel retail industry. There are several approaches to determine the potential of fashion trends. This study describes several approaches for trend forecasting and develops methods for measuring the potential of new fashion trends with unknown potential and without sales data. Firstly, merchandise testing focuses on the process of testing products with new trends. It describes the test store selection, forecasting methods and analyze the accuracy of forecasting with real data. Secondly, Sales-Based Store Network of Stores model is presented to examine cross-store sales similarity and establishes a store network using Collaborative Filtering method as in recommendation systems. A clustering method like K-means is studied to cluster the stores using store network data. Moreover, Distribution of Collection into Store method focuses on distributing the main collection made for a category into each stores using some constraints such as capacity of stores, rates of product attributes in the main collection. Integer programming is used to distribute the collection. The sales potential of the new planned products is crucial. It is necessary to choose the products with highest potential among the hundreds of products. Prediction of products’ demand based on stores addresses a prediction model using sales data containing store features and product attributes with different forecasting methods with different parameters. Furthermore, store-based forecasts are used in Distribution of collection into stores method while selecting the best products for the stores.