Öztürk Danışman, Gamze

Loading...

Profile URL

Name Variants

Öztürk Danışman, Gamze

G.,Öztürk Danışman

G. Öztürk Danışman

Gamze, Öztürk Danışman

Ozturk Danisman, Gamze

G.,Ozturk Danisman

G. Ozturk Danisman

Gamze, Ozturk Danisman

Danışman, Gamze Öztürk

Ozturk-Danisman, Gamze

Danisman, Gamze Ozturk

G.,Öztürk Danışman

G. Öztürk Danışman

Gamze, Öztürk Danışman

Ozturk Danisman, Gamze

G.,Ozturk Danisman

G. Ozturk Danisman

Gamze, Ozturk Danisman

Danışman, Gamze Öztürk

Ozturk-Danisman, Gamze

Danisman, Gamze Ozturk

Job Title

Dr. Öğr. Üyesi

Email Address

Gamze.danı[email protected]

Main Affiliation

International Trade and Finance

Status

Former Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

15

LIFE ON LAND

0

Research Products

16

PEACE, JUSTICE AND STRONG INSTITUTIONS

0

Research Products

14

LIFE BELOW WATER

0

Research Products

6

CLEAN WATER AND SANITATION

0

Research Products

3

GOOD HEALTH AND WELL-BEING

1

Research Products

17

PARTNERSHIPS FOR THE GOALS

0

Research Products

4

QUALITY EDUCATION

0

Research Products

2

ZERO HUNGER

0

Research Products

10

REDUCED INEQUALITIES

6

Research Products

7

AFFORDABLE AND CLEAN ENERGY

0

Research Products

13

CLIMATE ACTION

1

Research Products

1

NO POVERTY

0

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

1

Research Products

12

RESPONSIBLE CONSUMPTION AND PRODUCTION

1

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

3

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

0

Research Products

5

GENDER EQUALITY

0

Research Products

This researcher does not have a Scopus ID.

This researcher does not have a WoS ID.

Scholarly Output

18

Articles

16

Views / Downloads

200/2202

Supervised MSc Theses

2

Supervised PhD Theses

0

WoS Citation Count

770

Scopus Citation Count

862

WoS h-index

10

Scopus h-index

11

Patents

0

Projects

0

WoS Citations per Publication

42.78

Scopus Citations per Publication

47.89

Open Access Source

10

Supervised Theses

2

Google Analytics Visitor Traffic

| Journal | Count |

|---|---|

| SSRN Electronic Journal | 3 |

| Journal of Financial Stability | 2 |

| Ege Akademik Bakis (Ege Academic Review) | 1 |

| Ege Akademik Bakış | 1 |

| Finance Research Letters | 1 |

Current Page: 1 / 3

Scopus Quartile Distribution

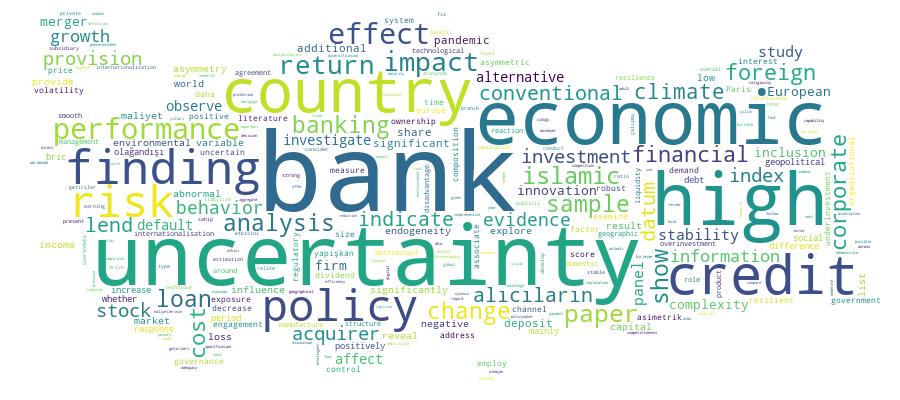

Competency Cloud

18 results

Scholarly Output Search Results

Now showing 1 - 10 of 18

Article Citation - WoS: 67Citation - Scopus: 74Esg Performance and Dividend Payout: a Channel Analysis(Academic Press Inc Elsevier Science, 2023) Bilyay-Erdogan, Seda; Danisman, Gamze Ozturk; Demir, EnderThis paper investigates the impact of environmental, social, and governance (ESG) performance on corporate dividend policy. We employ a panel data set comprised of 1094 non-financial listed firms in 21 European countries from 2002 to 2019. We show that companies with higher ESG performance are likely to pay higher dividends. Our results are robust to alternative variable definitions and specifications and address endogeneity concerns. We next investigate the possible transmission channels through which corporate ESG performance enhances dividend payouts. We present novel evidence that earnings and risk are the two possible channels through which ESG performance augments corporate dividends.Master Thesis Index Composition Changes Around the World: a Comprehensive Literature Review(Kadir Has Üniversitesi, 2023) Yenikalaycı, Yunus Emre; Öztürk Danışman, GamzeThis paper aims to provide a comprehensive literature review on composition changes for benchmark indexes not only for popular indexes such as the S&P 500 but for also global counterparts both in the developed world and the emerging market realm. By shedding light on the phenomena at play for index changes we seek to provide an overview starting from the roots of the literature to modern day works that reflect the current state of the topic and also where it is going. The theme of our study is orientated around the discussion range between information effects associated with index inclusions and exclusions, implications for liquidity, price pressure and demand shocks resulting with demand curve shifts and slopes for the demand curves of stocks and other subtopics such as thematic index composition changes. We dive into whether index composition changes en masse are rooted in information and/or demand driven explanations around the world.Article Citation - WoS: 40Citation - Scopus: 44Financial Resilience To the Covid-19 Pandemic: the Role of Banking Market Structure(ROUTLEDGE JOURNALS, 2021) Danışman, Gamze Öztürk; Demir, Ender; Zaremba, AdamThis article examines whether differences in banking market structures across countries influence the local stock market resilience to the COVID-19 pandemic. Using a sample of 66 countries for the period January 2020 to July 2020, our findings demonstrate that countries with more concentrated banking systems, with a higher presence of foreign banks, and a higher share of Islamic banks are more resilient to the pandemic. Considering the banking regulatory differences between countries, we observe that equity markets of countries with stricter regulatory requirements on capital and liquidity are more resilient to the COVID-19. Finally, regarding banking sector performance indicators, our findings show that while stock reactions of countries with more stable banking systems are more resilient to the pandemic; countries with more credit to deposit ratio, overhead costs, high provisions and nonperforming loans are more vulnerable. Our findings provide important implications for policymakers, regulatory bodies and investors.Article Citation - WoS: 72Citation - Scopus: 86Loan Loss Provisioning of Us Banks: Economic Policy Uncertainty and Discretionary Behavior(Elsevier Inc, 2021) Öztürk Danışman, Gamze; Demir, Ender; Ozili, Peterson K.This paper examines the effect of economic policy uncertainty (EPU) on loan loss provisions (LLP). Using a sample of 6384 US banks and yearly data from 2009 to 2019 and addressing endogeneity (GMM and IV estimations), the findings reveal that in times of higher economic policy uncertainty, banks tend to increase their loan loss provisioning. Considering the four components of EPU, the findings document that the majority of the explanatory power on loan loss provisions originates from news-based and tax expiration indices. Moreover, US banks discretionally use loan loss provisions in normal times, especially for capital management and income smoothing. In uncertain times, they use provisions for income smoothing rather than capital management and after controlling for the discretionary behavior, the positive relationship of EPU and LLPs continue to hold. Additional analysis indicates that private banks conduct more income smoothing through provisions in uncertain times as compared to listed banks. The findings of the study highlight EPU as an additional procyclical factor to influence bank provisioning behavior and offer some relevant policy implications.Article Citation - WoS: 1Technological Innovations and Firm Internationalisation(Sosyoekonomi Soc, 2022) Ozturk-Danisman, GamzeThis paper explores the relevance of technological innovations for the internationalisation of manufacturing firms. It differentiates between two technological innovations: eco-innovations and generic-technological innovations (i. e., intelligent manufacturing). By pooling the Flash Eurobarometer-415 and -433 surveys, we use a broad firm-level sample of 4954 European and nonEuropean (the US and Switzerland) manufacturing firms. Appling the Heckman selection model, the findings indicate that eco-innovations positively affect the decision of the firms to internationalise whilst showing no significant impact on the level of international operations. On the other hand, generic-technological innovations positively affect both the decision and the level of global operations.Article Citation - WoS: 43Citation - Scopus: 45Bank Credit in Uncertain Times: Islamic Vs. Conventional Banks(Elsevier Ltd, 2020) Bilgin, Mehmet Hüseyin; Danışman, Gamze Öztürk; Demir, Ender; Tarazi, AmineThis paper explores whether the impact of economic uncertainty on credit growth differs for Islamic vs. conventional banks. Using a sample of 416 banks (58 Islamic and 358 conventional) in 12 countries, the findings indicate that an increase in economic uncertainty significantly decreases the credit growth of conventional banks but does not have any significant impact on Islamic banks’ credit growth. Our results are robust to alternative specifications and addressing endogeneity concerns using GMM estimators. We further observe that our findings are stronger for the following countries: (1) countries with explicit deposit insurance protection system for Islamic banks, (2) lower foreign dominance, and (3) countries with a higher share of deposits and assets in Islamic banks.Article Citation - WoS: 88Citation - Scopus: 98Economic Uncertainty and Bank Stability: Conventional Vs. Islamic Banking(Elsevier Science Inc, 2021) Bilgin, Mehmet Huseyin; Danisman, Gamze Ozturk; Demir, Ender; Tarazi, AmineIn this paper, we explore whether economic uncertainty differently affects the default risk of Islamic and conventional banks. Using a sample of 568 banks from 20 countries between 2009 and 2018, we use the World Uncertainty Index (WUI) by Ahir et al. (2018) to conduct a study based on a comparable measure across countries. Our findings indicate that economic uncertainty increases the default risk of conventional banks but does not affect Islamic banks' default risk. To understand why, we explore the influence of religiosity, institutional factors, and bank-level heterogeneity. We observe that Islamic banks' default risk is not significantly affected by uncertainty in all types of countries, but such a difference with conventional banks mainly holds for banks with higher income diversification, larger size, and that are publicly traded. Moreover, our findings show that conventional banks suffer more from uncertainty in terms of stability in countries with higher religiosity and with a higher share of profit-loss sharing (PLS) contracts. Our results are robust to alternative estimation techniques to deal with endogeneity and to alternative variable measurements.Article Citation - WoS: 85Citation - Scopus: 88The Impact of Economic Uncertainty and Geopolitical Risks on Bank Credit(Elsevier Inc., 2021) Demir, Ender; Danışman, Gamze ÖztürkThis paper compares the effects of economic uncertainty and geopolitical risks on bank credit growth. Using a sample of 2439 banks from 19 countries for the period of 2010–2019, our findings indicate that economic uncertainty causes a significant decrease in overall bank credit growth while no such significant overall effect of geopolitical risks is documented. Further analysis on loan types shows that the highest negative impact of economic uncertainty is observed on corporate loans. Geopolitical risk, however, dampens consumer and mortgage loans. Additional analyses on bank heterogeneity reveal that the credit behavior of foreign and publicly listed banks are more immune to such risks.Article Citation - WoS: 2Asymmetric Cost Behavior and Acquirer Returns: Evidence From U.s. Mergers(Ege Univ, 2019) Uğurlu, Mine; Öztürk Danışman, Gamze; Bilyay-Erdoğan, Seda; Vural-Yavaş, ÇiğdemThis paper investigates the asymmetric behavior of the selling, general and administrative (SG&A) costs of acquirers, and reveals its effects on mergers & acquisitions (M&A) performance in a one-year event window. It is based on a sample of 6888 M&As completed in the U.S. during the 2003-2015 period and employs panel data regressions. The results show that 73% of the acquirers display asymmetric cost behavior. A significant negative relation is found between cost stickiness and acquirers' abnormal returns following the merger announcement. Competition in the market for corporate control is positively related with acquirer returns but exacerbates the negative effects of cost-stickiness on abnormal returns of acquirers. The acquirers' risk of default is significantly negatively related to the abnormal returns they generate. This adverse effect of default risk on returns is stronger for acquirers with anti-sticky costs. Acquirer risk offsets the positive effects of competition on returns. Acquirers with sticky costs have lower abnormal returns than those with anti-sticky costs in a one-year window. The present study contributes to the literature by revealing the asymmetric cost behavior of acquirers involved in merger activity during the last decade, and provides evidence for an alternative explanation for the lower abnormal returns of the acquiring firms.Article Asimetrik Maliyet Davranışı ve Alıcıların Getirileri: A.b.d. Birleşmelerinden Bulgular(2019) Ugurlu, Mine; Danışman, Gamze Öztürk; Bılyay-erdogan, Seda; Vural-yavas, CigdemBu çalışma alıcıların satış, genel ve yönetim maliyetlerinin asimetrik davranışlarını incelemekle birlikte; “Birleşme ve Satın Alma” performanslarına olan etkisini 1 yıllık olay penceresinden analiz etmektedir. Çalışma A.B.D.’de 2003-2015 yılları arasında tamamlanan 6,888 birleşme ve satınalmaya dayanmakta ve panel veri regresyonları kullanmaktadır. Sonuçlar alıcıların 73%’ünün maliyetlerinin asimetrik davranış sergilediğini göstermektedir. Birleşme duyurusunun ardından maliyet yapışkanlığı ile alıcıların olağandışı getirileri arasında anlamlı ve negatif bir ilişki olduğu saptanmıştır. Piyasadaki rekabet alıcıların getirilerini olumlu etkiler, ancak yapışkan maliyetlerin alıcıların olağandışı getirileri üzerindeki olumsuz etkisini daha da artırır. Ayrıca alıcıların temerrüt riskinin olağandışı getiriler üzerinde anlamlı ve negatif yönde etkisi vardır. Bununla birlikte, temerrüt riskinin getiriler üzerindeki olumsuz etkisi yapışkan olmayan maliyet yapısı olan alıcılar için daha kuvvetlidir. Alıcıların riski rekabetin getiriler üzerindeki pozitif etkisini azaltmaktadır. Bir yıllık olay penceresinden incelendiğinde, yapışkan maliyet yapısına sahip alıcıların yapışkan olmayan maliyet yapısına sahip alıcılara göre daha az olağandışı getirilere sahip olduğu gözlemlenmiştir. Bu çalışma 2003-2015 yılları arasında gerçekleşen birleşmelerde rol alan alıcıların asimetrik maliyet davranışlarını ortaya çıkararak ve alıcı firmaların daha düşük olağandışı getiri elde etmelerine alternatif bir açıklama getirerek literatüre katkıda bulunmuştur.